Part D prescription drug coverage is an add-on option available to those who have Original Medicare.

These plans are provided through private companies that charge a monthly premium and, often, a deductible for coverage. For those enrolled in original Medicare, it is prudent to also enroll in a prescription drug plan to avoid exposure to drug costs as well as higher premiums that will apply if you enroll in coverage later.

Each private company that offers prescription drug coverage has a drug list, also called a formulary, listing all the drugs that the company will cover. This list may change each year and so it is important for Medicare recipients to review the newly published formulary each year. Medicare recipients may change their prescription drug coverage plan each year to ensure their drugs are covered.

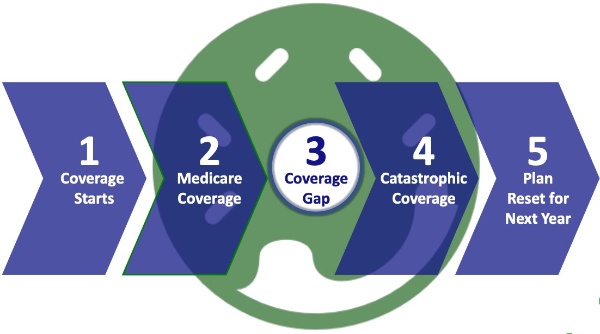

The Donut Hole Explained

Medicare prescription drug coverage (Part D) plans have a coverage gap, often referred to as a “Donut Hole”. In short, it refers to a coverage gap that comes into effect after you have spent a certain amount of money for covered drugs. While in this coverage gap, you will have to pay all costs out-of-pocket for your prescriptions up to a defined limit. Once the defined limit is reached, also called catastrophic coverage, Medicare begins covering the drug costs again.

The graphic below illustrates the concept